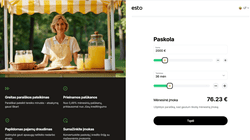

Esto

gauti paskolą

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Suma: 500౼10000 EUR

Terminas: 6౼120 mėnesių

Palūkanos: nuo 26.33 % BVKKMN

Amžius: 19౼70 metai

Amount: 500౼10000 EUR

Term: 6౼120 months

Interest: from 26.33 % APR

Age: 19౼70 years

Pavyzdys: Skolinantis 500 eurų 48 mėn. terminui, metinė palūkanų norma 8,9%, sutarties sudarymo mokestis 7,90 eur, mėnesinis administravimo mokestis 1,9 eur, mėnesinė įmoka 16,19 eur, bendra kliento mokama suma 777,12 eur, BVKKMN -26,33%. Grąžinant pasiskolintus 300 eur per pirmus 36 mėn., mokant ne mažesnę nei 13,99 eur mėnesinę įmoką ir sumokant 10,50 eur pinigų išėmimo mokestį, metinė palūkanų norma 23,40%, mėnesinis administravimo mokestis 3,26 eur, bendra kliento mokama suma 511,43 eur, BVKKMN -47,16%. Finansavimas nuo smulkių kasdienių išlaidų iki didesnių svajonių.

Esto – Always have money at hand!!

Unlike a line of credit, a loan is a one-time sum of money that is transferred directly into your personal bank account. When you apply for a loan, you choose a fixed repayment schedule and a specific time period for repayment. You will make regular loan payments, including interest, based on this pre-set schedule until the loan is fully repaid.

Choose a suitable loan and fill out the application. It will take only a minute and does not require signing a contract. Your application will be processed in real time. Review the terms and conditions, then sign the contract with one click. After signing the contract, we will transfer the money to your selected bank account within one business day. Log in to your ESTO account to manage contracts, contact support and more.

![]() Phone: -

Phone: -

![]() Email: info@esto.lt

Email: info@esto.lt

![]() Website: essto.lt

Website: essto.lt

When do I have to make my payment?

The payment deadline for all current contracts is the same and unchanged – by the 15th of each month.

I received a negative decision when applying for a consumer loan. What could be the reason for this?

There may be several reasons for receiving a negative decision on a consumer loan, for example: You do not have a stable or sufficiently high income; You have an active debt to ESTO; The gap between your obligations and income is too small; You have other active obligations in the credit information register; Your credit rating is not good enough at the moment. To check your creditworthiness, ESTO takes into account your income, obligations and payment habits.

What if I can’t make my monthly payments?

If you have lost your job, your income has dropped or you are experiencing other difficulties, we can assess whether it is possible to offer you an extension of the loan repayment period, thereby reducing the monthly payment. We can consider concluding an agreement to defer payments for up to three months.

Is it possible to change the contract term to a shorter one?

Unfortunately, ESTO does not offer to change the loan term. You can always make a larger payment to reduce the loan balance.