FjordBank

gauti paskolą

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

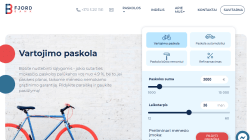

Suma: 600౼25000 EUR

Terminas: 12౼120 mėnesių

Palūkanos: 7.9౼38 % BVKKMN

Amžius: nuo 21 metai

Amount: 600౼25000 EUR

Term: 12౼120 months

Interest: 7.9౼38 % APR

Age: from 21 years

Pavyzdys: skolinantis 5 000 €, sutartį sudarant 48 mėn. laikotarpiui, metinė palūkanų norma – 14,5 %, mėnesio įmoka – 137,89 €, bendra paskolos gavėjo mokama suma – 6619,71 €, bendra vartojimo kredito kainos metinė norma – 15,5 %. Visada fiksuotos metinės palūkanos %; jokio sutarties mokesčio; jokio mėnesinio administravimo mokesčio; vartojimo paskolos suma iki 25 000 Eur; paskolos laikotarpis – 12–120 mėn.; paskoloms taikoma minimali bendra kredito kainos metinė norma BVKKMN – 7,9%, maksimali BVKKMN – 38%. Sprendimas per valandą, vartojimo paskola dar tą pačią dieną.

FjordBank – Specialized loan and deposit bank!

We specialize in consumer loans and online lending. Whatever plans you have, we will help you implement them: a loan for travel or household appliances, maybe you are planning to change your car and you need a car loan, or you just want to renovate your home. In addition, we refinance our existing loans and borrowings, so we can help reduce your monthly payment or borrow additional funds.

Easy, convenient and fast. This is our goal from day one. We have designed this process to make it easier and easier to get a loan or deposit online. We accept applications for loans and deposits only online, so we respond quickly and offer very good conditions without physical divisions. You can always use the loan or deposit calculator and evaluate the conditions.

![]() Phone: +370 5251 1181

Phone: +370 5251 1181

![]() Email: info@fjordbank.lt

Email: info@fjordbank.lt

![]() Website: fjordbank.lt

Website: fjordbank.lt

Who can apply for a loan?

Loan applications can be submitted to Fjord Bank by all citizens of the Republic of Lithuania who have reached the age of 21, who have a permanent residence permit in Lithuania, who have a positive credit history and a net monthly income of at least 500 euros.

How to get a loan?

After completing the application form, you can verify your identity using a mobile signature or using electronic means that allow you to transmit video in real time.

When will I receive a response to my request?

We usually respond immediately to a request on our website. If the answer is yes, you can immediately conclude a loan agreement. In some cases, the decision may take longer and we will ask you to provide additional documents confirming your financial situation. After receiving such documents, the decision on the loan application must be submitted within one business day.

How long does it take to transfer money?

Usually, money is transferred on the same day, but in some cases, due to the transfer procedure in individual banks, the money may be credited to the account the next day. Fjord Bank undertakes to transfer money to the borrower’s account no later than within two business days from the date of the agreement.

Can I transfer more than indicated in the payment schedule?

Of course, you can deposit a larger amount of money at any time. Every time you pay an amount that is slightly more than the monthly payment, a partial repayment is made. The credit balance is reduced and the payment schedule is recalculated, shortening the loan repayment period.