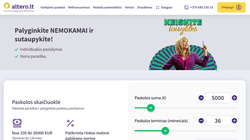

Altero

gauti paskolą

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Suma: 50౼35000 EUR

Terminas: 3౼120 mėnesių

Palūkanos: 8౼38.08 % BVKKMN

Amžius: nuo 18 metai

Amount: 50౼35000 EUR

Term: 3౼120 months

Interest: 8౼38.08 % APR

Age: from 18 years

Pavyzdys: Skolinantis 5 000 eurų, vartojimo kredito sutartį sudarant 60 mėnesių, metinė palūkanų norma – 3.4 %, mėnesio įmoka – 103.69 eurai, bendros vartojimo kredito kainos metinė norma – 9.33 %, bendra vartojimo kredito gavėjo mokama suma – 6 221.4 eur. Bendros vartojimo kredito kainos metinė norma gali būti nuo 8 % iki 38,08 %, mėnesio įmoka nuo 103.69€ iki 159.27€. Skirtingi kreditoriai gali taikyti ir kitus mokesčius, susijusius su vartojimo kreditu, todėl būtinai susipažinkite su visomis jų siūlomų kreditų sąlygomis. Paskola suteikiama įvairiems Jūsų poreikiams.

Altero – Compare loan offers!

Altero is a loan comparison platform where, by filling out one application, you can get free consumer loans, car loans and leasing, offers for consolidation and refinancing of loans from cooperation partners – banks and lenders. Altero will save you valuable time and possibly more than a thousand euros.

As soon as you complete the application, a virtual account will be created for you, in which you can analyze the received loan offers. You will also receive information about the decisions made by the lenders by email. In your account, you will be able to compare offers from different lenders and choose the best offer based on the amount available, monthly payment, interest rate, convenience and other benefits.

![]() Phone: +370 680 330 33

Phone: +370 680 330 33

![]() Email: info@altero.lt

Email: info@altero.lt

![]() Website: altero.lt

Website: altero.lt

How long does it take to get a loan decision?

You will receive your first responses in about an hour. Then all that remains is to sign an agreement with the lender, and the money will be transferred to your account.

What are the requirements for applying for a loan?

The loan is available to all residents of Lithuania and foreign citizens who have a residence permit in Lithuania from the age of 18. And those who have a permanent official income in Lithuania or abroad must receive a permanent income of at least 200 euros per month after taxes.

In what cases can a loan be refused?

In most cases, a loan is denied after receiving a negative answer from the register of debtors about the borrower’s credit history or when the income received is insufficient to meet obligations.

Can I combine multiple loans into one loan?

Yes, you can combine multiple quick loans and pay one monthly payment to one lender.

Can you get a loan with bad credit history?

Altero works with various lenders. Each of them has its own credit policy. By filling out the application, you will have the opportunity to find out if you can get a loan at the moment, given your credit history. By filling out the application, you do not commit to anything. This service costs nothing.