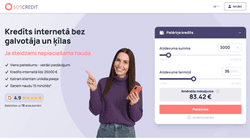

SosCredit

saņemt kredītu

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Summa: 100౼25000 EUR

Termiņš: 3౼84 mēneši

Likme: 8.9౼29.9 % gadā

Vecums: 18౼75 gadi

Amount: 100౼25000 EUR

Term: 3౼84 months

Interest: 8.9౼29.9 % per year

Age: 18౼75 years

Piemērs: summa 4200 EUR, termiņš 72 mēneši, līguma noformēšanas maksa 336 EUR, gada procentu likme (GPL) 20,86%, kopējā summa, kas jāatmaksā 7440,96 EUR, ikmēneša maksājums 98,68 EUR. Patēriņa kredīta, kredītu apvienošanas, kredītlīnijas termiņš no 3 līdz 84 mēnešiem, kredīta summa no 500 EUR līdz 25000 EUR un gada procentu likme 12% — 29,9%. Ātrā kredīta termiņš no 3 līdz 60 mēnešiem, kredīta summa no 100 EUR līdz 10000 EUR un gada procentu likme 12% — 29,9%. Auto kredīta termiņš no 12 līdz 84 mēnešiem, kredīta summa no 1000 EUR līdz 15000 EUR un gada procentu likme 8,9% — 19,9%.

SosCredit – No guarantor and collateral up to € 1500!

Credit limit for new clients up to 1000 €. And no interest period or 0% commission. SosCredit credit line is a loan with a set available limit amount, however, without a fixed repayment schedule, you can set the repayment schedule yourself by choosing a monthly payment. A line of credit is a great solution when you pay interest only on the amount you spent.

We are always ready to help if you urgently need money: Transfer money to any bank account in Latvia; Fast decision making; We issue loans with a good credit history; Without collateral and surety. You can receive money repeatedly as many times as necessary within the limit. With each bill payment, the available credit line amount is renewed.

![]() Phone: -

Phone: -

![]() Email: info@soscredit.lv

Email: info@soscredit.lv

![]() Website: soscredit.lv

Website: soscredit.lv

Can I get a line of credit?

The line of credit can be obtained from the age of 18 to 75. In order to apply for a credit line, you need to be solvent and have a bank account in any credit institution in Latvia, a mobile phone. It is necessary to fill out the application form (for new clients to make a registration payment), wait for the decision, which will be reported by the service specialist, and / or receive it in the form of an SMS message, and / or by e-mail.

Is a bond or guarantor required?

There is no need for a guarantor or collateral to obtain a credit line.

What is a commission-free credit line?

For new customers, the first 60 days can be offered commission-free. It means. there will be no commission for the first 60 days.

What should I do if I cannot pay the money within the specified period?

The credit line must be repaid according to the schedule, in case of non-compliance with the payment schedule, penalty interest will be applied. In case of a delay in repayment of the loan, please contact customer service.

Why was my application for a line of credit declined?

An application for a line of credit may be rejected if the information provided is incorrect or entered in the wrong order, the applicant has outstanding debt obligations.