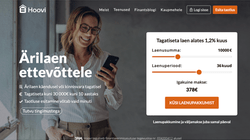

Hoovi

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Summa: 1000౼100000 EUR

Periood: 3౼120 kuud

Aastaintress: alates 12 %

kuni 30000 € ilma tagatiseta

Amount: 1000౼100000 EUR

Term: 3౼120 months

Interest: from 12 % per year

up to 30000 € without collateral

Ärilaen ettevõttele. Hoovi ärilaen on mõistliku intressi ja soodsate tingimustega käibekapital ettevõtjale. Osaline ja täielik ennetähtaegne tagastamine tasuta ja etteteatamisperioodita. Me hindame iga kliendi vajadusi individuaalselt ning jõuame koos parima lahenduseni. Laenu taotlev ettevõte peab olema Eestis registreeritud ja omama mõnes Eesti pangas kontoväljavõtet. Rohkem nõudeid ettevõttele ei ole. Sobib ka täiesti alustav ettevõte ilma senise käibeta. Laenupakkumise küsimiseks ei pea kontot looma. Lihtsalt täida taotlusvorm ja saadame Sulle pakkumise.

Hoovi – Business loan for a company!

A Hoovi business loan is a loan for a company that urgently needs working capital or unexpected expenses. Hoovi’s business loan requires no collateral and can be deposited into your company’s account within an hour. The business loan can be repaid at any time, without prior notice or penalties. Created to finance short-term investments and attract working capital.

You don’t need to create an account to request a loan quote. Simply fill out the application form, and we’ll send you an offer. Completing the form takes about one minute, and we’ll send you an offer the same day. After discussing the terms with our account manager and confirming the offer meets the terms, we’ll digitally sign the contracts. You can sign them with Smart-ID, Mobile-ID, or an ID card. We typically issue the loan within 30 minutes of signing the contract. After that, we’ll issue an invoice every month a few days before the payment deadline.

![]() Phone: (+372) 5191 9192

Phone: (+372) 5191 9192

![]() Email: mikk.laoshoovi.ee

Email: mikk.laoshoovi.ee

![]() Website: hoovi.ee

Website: hoovi.ee

Can I repay my business loan early?

You can repay your Hoovi small business loan early at any time, in full or in part. Simply notify your account manager, who will then send you a statement showing the remaining loan balance. Once the remaining balance is repaid, interest stops accruing, and the loan is considered repaid. There is no notice period or contractual penalty for early repayment.

How long does the business loan application process take and what documents are required?

A business loan from Hoovi is essentially a working capital loan, not an investment loan, so the application process is very quick and convenient. All you need to do is provide bank statements for your company and board member for the past 12 months, and we’ll send you a loan offer within an average of one hour per business day.

What conditions must a company meet to apply for a loan?

A company applying for a loan must be registered in Estonia and have an account statement from an Estonian bank. There are no other requirements. A completely new company with no previous turnover is also eligible. The loan must be guaranteed by a solvent board member or shareholder who can assume the company’s liabilities should the business plan fail. Therefore, the guarantor must not have any active payment defaults.