BoonusLaen

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Summa: 100౼5000 EUR

Periood: 3౼99 kuud

Aastaintress: 26.85౼47.04 % KKM

Vanus: alates 19 aastat

Amount: 100౼5000 EUR

Term: 3౼99 months

Interest: 26.85౼47.04 % APR

Age: from 19 years

Laenunäide: Krediidi kulukuse maksimaalne määr on 47,04% aastas järgmistel näidistingimustel: laenulimiit 2000€, krediidi tagasimaksmiseks ja krediidi kogukulu kandmiseks tehtavate maksete kogusumma 2424,44 (sisaldab lepingutasu 0€), fikseeritud aastaintress 39,1794%. Määr on arvestatud eeldusel, et laenulimiit võetakse kasutusele viivitamata ja täies mahus ning makstakse tagasi 12 võrdse tagasimaksena võrdsete ajavahemike järel alates kuu aja möödumisest laenulimiidi kasutusse võtmisest. Lihtne ja kiire taotlemine täielikult interneti teel. Intress alates 2% kuus!

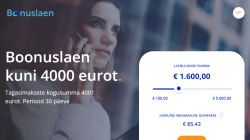

BoonusLaen – Bonus loan up to 4000 euros!

A bonus loan is the same loan product as a credit account, loan limit or credit limit. You have a maximum limit within which you can make payments. With a bonus loan, you only pay daily interest on the amount used. Let’s say your maximum limit is 4,000 €, but you used 300 €. In this case, the daily interest is calculated from EUR 300. There are different ways to return the used amount – return the entire amount, half at once, or make the minimum monthly payments.

The contribution amount is at least 5% of the used amount, including interest, but not less than 10 euros. The daily interest rate for the bonus loan is 0.1318%. The refundable amount can be reused at any time. The bonus loan cannot be used by existing customers of Ferratum Bank plc. Send us a loan application. We will review your application and send you a verification code by email. After the approval of the loan, we will transfer the money to you!

![]() Phone: 6 652 420

Phone: 6 652 420

![]() Email: ferratum@ferratumbank.ee

Email: ferratum@ferratumbank.ee

![]() Website: boonuslaen.ee

Website: boonuslaen.ee

Who can apply for a loan?

The bonus loan can be used by individuals over 19 years old. You must be a permanent resident of Estonia with permanent registration. You must have a checking account with a bank operating in Estonia so that we can transfer money to you. A valid document is required for personal identification. You must have a specific address in the population register. A salary, pension, parental allowance or other benefits are suitable for this. Before concluding a contract, read the terms and conditions and, if necessary, consult with a specialist.

How is the bonus loan issued?

If you are a new client, you must first identify yourself and confirm the loan without a verification code. If you are already our regular customer, the loan amount will be paid after receiving a positive decision on the loan without a confirmation code. The loan amount will be transferred only to your personal bank account, which was indicated in the loan application.

How long does it take to make a decision on a loan?

Consideration of a loan application and making a decision will take only a few minutes. We will send replies during customer support hours. If you sent your request outside of business hours, we will respond to you the next morning.

How soon will I need to repay the bonus loan?

The bonus loan does not have a specific term. In the case of a bonus loan, you can choose whether to pay the minimum installment or an amount in excess of the established installment. Repayment of a larger amount will shorten the loan term.