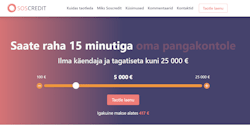

SosCredit

active Estonian campaigns

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

Summa: 100౼25000 EUR

Periood: 1౼120 kuud

Aastaintress: kuni 49.95 % KKM

Vanus: alates 18 aastat

Amount: 100౼25000 EUR

Term: 1౼120 months

Interest: up to 49.95 % APR

Age: from 18 years

Laenunäide: 2000 € laenu võtmisel 12 kuuks on igakuine maks 203.87 € ja maksusumma kokku 2446.39 € krediidi kulukuse määraga APR 49.95%. Maksimaalne KKM: 49.95%. Uutele klientidele laenud kuni 5 000 € ja esimesed 30 päeva intress 0%. Minimaalne laenu tagasimakse periood on 30 päeva. Fikseeritud intressimäära ja tähtajaga laen pärast laenu väljastamist maksetingimusi ei muudeta. Lepingu sõlmimisel määratakse kindlaks nii laenusumma ja intressimaksed kui ka makseperiood.

SosCredit – Get money in 15 minutes!

We are always ready to help you if you urgently need money: money transfer to any bank account in Estonia; simple online application; no collateral or guarantor; fast decision-making; we keep all customer data confidential. You can receive money as many times as you need. Each client’s request is assessed individually, so it is important that the client provides accurate information when filling out the request. After reviewing the application, the client may be offered a smaller loan amount.

To apply for a loan, you must first fill out an application. After submitting the application, you must wait for a decision. If your request is approved, the funds will be credited to your bank account. The average time to receive a loan is 15 minutes if the lender and borrower’s bank account are in the same bank. If the bank account is in another bank, the confirmed amount of funds will be received within one day, but not more than three days from the date of consideration of the application.

![]() Phone: -

Phone: -

![]() Email: info@soscredit.ee

Email: info@soscredit.ee

![]() Website: soscredit

Website: soscredit

How can I apply for a loan?

You can apply for a loan online by filling out the appropriate loan application on the lender’s website and providing the necessary information.

What are the loan repayment terms?

Repayment terms vary by lender, but you can typically choose between flexible monthly payments or pay the entire amount at once.

What are the most common costs associated with a loan?

The main costs associated with a loan are interest, contract fees, and late fees if the loan is not repaid on time.

What happens if I fail to repay my loan on time?

If you fail to repay your loan on time, the lender may charge you a late fee and your debt may be referred to a collection agency.

Do I have to have a fixed income?

Yes, major lenders require a regular income to ensure the borrower’s ability to repay the loan.