HipoCredit

active Lithuanian campaigns

FREE LOANS | FAST LOANS | LOANS FROM 18 YEARS | CAR LOANS | MORTGAGE LOANS | CONSUMER LOANS | SHORT-TERM LOANS | LONG-TERM LOANS

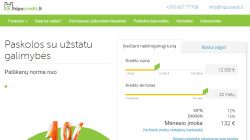

Suma: 1000౼500000 EUR

Terminas: 3౼240 mėnesių

Palūkanos: 12౼18 % per metus

Amžius: nuo 20 metai

Amount: 1000౼500000 EUR

Term: 3౼240 months

Interest: 12౼18 % per year

Age: from 20 years

Pavyzdys: bendra kredito suma – 10 000 EUR, sutarties terminas – 36 mėnesiai, metinė palūkanų norma – 12%, visa palūkanų suma – 1957.10 EUR, kredito sutarties administravimo mokestis 300 EUR, įkeičiamo turto vertinimo išlaidos — 80 EUR, bendra kredito kaina – 2 337.10 EUR, bendra kredito gavėjo mokama suma – 12 337.10 EUR, bendra kredito kainos metinė norma (BKKMN) – 15.75%.

HipoCredit – Mortgage loans!

Mortgage refinancing is a great solution for those who have multiple consumer loans or quick loans and are looking for better loan repayment terms. You guarantee the refinancing of the loan by mortgaging real estate. Unlimited loans are refinanced. The percentage is 3-4 times lower. The possibility of additional, issued in just 1 day from the submission of documents. Flexible terms of loan repayment.

Hipocredit provides a car loan, the repayment of which is guaranteed by a mortgage. 2 times cheaper than the most popular consumer lending company. The money is paid in just 1 day. from filing documents. There are no restrictions on the age, make or seller of the vehicle you buy. A loan is provided in the amount of up to 75% of the value of the property. There is no need to mortgage the car, its property belongs to you. No down payment. KASKO insurance is not required.

![]() Phone: +370 607 77708

Phone: +370 607 77708

![]() Email: info@hipocredit.lt

Email: info@hipocredit.lt

![]() Website: hipocredit

Website: hipocredit

What do I need to get a loan from Hipocredit?

You must be a citizen of the Republic of Lithuania or have lived in Lithuania for at least 20 years. Hipocredit provides loans to individuals and legal entities secured by real estate, so you must have ownership of real estate in Lithuania. Earned income and creditworthiness are not the main criteria for obtaining a loan.

How long does it take to receive money?

Our practice shows that, on average, you receive money into your bank account within 2-4 business days after applying for a loan. It depends on two factors: how quickly you email the property documents, photographs, a copy of your ID, and how long it takes for the Registration Center to approve the mortgage agreement (usually the same day).

How much can I borrow?

Hipocredit can borrow against real estate collateral – up to 75% of the market value of real estate. Loan amount from 1,000 to 500,000 euros.

What is the possible loan repayment period?

We offer loans for a period from 3 months to 20 years. If possible, you can always repay the loan earlier.

Can I get a loan if my property is already mortgaged?

No, but you can refinance an existing loan through Hipocredit, contact our specialists and find out how we can help you.